How Savvy Investors Utilize 1031 Exchanges to Defer Capital Gains and Expand Wealth

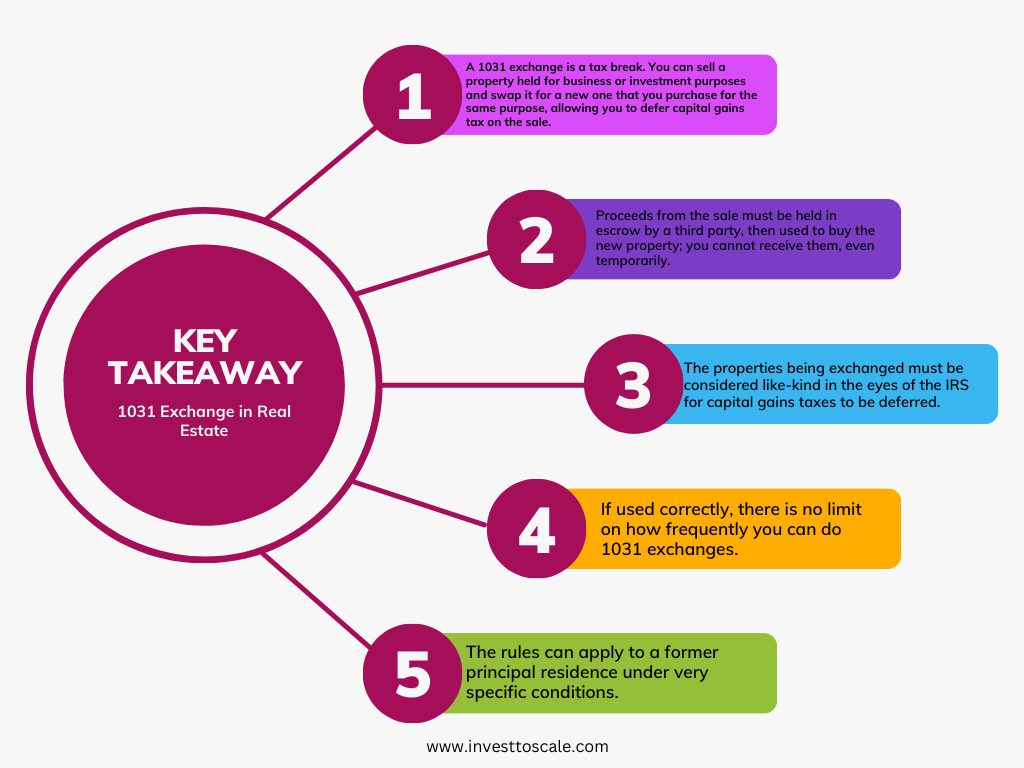

A 1031 exchange refers to the exchange of one real estate investment property for another, enabling the deferral of capital gains taxes. This term, deriving from Section 1031 of the Internal Revenue Code (IRC), is commonly discussed among real estate agents, title companies, investors, and others. Some even go as far as using it as a verb, saying, “Let’s 1031 that building for another.”

Understanding the various components of IRC Section 1031 is crucial for real estate investors before considering its application. For instance, exchanges are limited to like-kind properties, and there are restrictions from the Internal Revenue Service (IRS) regarding the use of vacation properties. Additionally, investors need to be aware of the tax ramifications and time constraints associated with these exchanges.

Whether you’re considering a 1031 exchange or simply curious about it, here’s what you need to know about the regulations.

What is a Section 1031 Exchange?

In basic terms, a Section 1031 exchange (also referred to as a like-kind exchange or a Starker exchange) involves swapping one investment property for another. While most exchanges are taxable as sales, if yours meets the requirements of Section 1031, you may either have no tax or limited tax due at the time of the exchange.

Essentially, this allows you to change the form of your investment without triggering a cash-out or recognizing a capital gain, according to the IRS. This enables your investment to continue growing tax-deferred. There are no restrictions on how often you can engage in a Section 1031 exchange. You can roll over the gain from one piece of investment real estate to another and continue this process. Although you may have a profit with each swap, you defer paying tax until you eventually sell for cash, often many years later. If executed as planned, you’ll only pay tax once at a long-term capital gains rate (currently 15% or 20%, depending on income, with some taxpayers paying 0% as of 2022).

To qualify, most exchanges simply need to be of like-kind—a term that might not mean what you expect. You can exchange various types of properties, such as an apartment building for raw land or a ranch for a strip mall. The rules are surprisingly flexible; you can even exchange one business for another, although there are pitfalls for the unwary.

Section 1031 applies to investment and business property, though there are circumstances where the rules can also apply to a former primary residence. Additionally, there are methods to use Section 1031 for swapping vacation homes, although this option is narrower than in the past.

Special Rules for Depreciable Property

There are special rules when it comes to exchanging depreciable property. This type of exchange can trigger depreciation recapture, which is taxed as ordinary income. Generally, swapping one building for another can help avoid this recapture. However, if you exchange improved land with a building for unimproved land without a building, the depreciation previously claimed on the building will be recaptured as ordinary income.

Given these complexities, it’s advisable to seek professional assistance when engaging in a Section 1031 exchange.

Changes to 1031 Rules

Before the Tax Cuts and Jobs Act (TCJA) was enacted in December 2017, some exchanges involving personal property qualified for a Section 1031 exchange. Now, only real property as defined in Section 1031 qualifies. However, it’s worth noting that the TCJA’s full expensing allowance for certain tangible personal property may help offset this change.

The TCJA includes a transition rule allowing a 1031 exchange of qualified personal property in 2018 if the original property was sold or the replacement property was acquired by December 31, 2017. This transition rule is specific to the taxpayer and does not permit a reverse 1031 exchange where the new property was purchased before the old property is sold.

Section 1031 Exchange Timelines and Rules

Traditionally, an exchange involves a direct swap of properties between two parties. However, finding someone with the exact property you want who also wants your property is unlikely. Therefore, most exchanges are delayed, three-party, or Starker exchanges (named after the first tax case that allowed them).

In a delayed exchange, you require a qualified intermediary, who holds the cash after you sell your property and uses it to buy the replacement property for you. This three-party exchange is treated as a swap.

There are two crucial timing rules in a delayed exchange:

45-Day Rule: Within 45 days of selling your property, you must designate the replacement property in writing to the intermediary.

180-Day Rule: You must close on the new property within 180 days of selling the old property.

Reverse Exchange

It’s also possible to buy the replacement property before selling the old one and still qualify for a Section 1031 exchange. In this scenario, the same 45- and 180-day timeframes apply.

To qualify, you must transfer the new property to an exchange accommodation titleholder, identify a property for exchange within 45 days, and then complete the transaction within 180 days after acquiring the replacement property.

Section 1031 Exchange Tax Implications: Cash and Debt

If there is cash left over after the intermediary acquires the replacement property, it will be paid to you at the end of the 180 days. This cash, known as boot, will be taxed as partial sales proceeds from the sale of your property, typically as a capital gain.

One common pitfall involves failing to consider loans. You must account for mortgage loans or other debt on both the property you relinquish and the replacement property. If you don’t receive cash back but your liability decreases, it will still be treated as income, akin to cash.

For example, if you had a $1 million mortgage on the old property but the mortgage on the new property obtained through the exchange is only $900,000, you’ll have a $100,000 gain classified as boot and taxed accordingly.

Section 1031s for Vacation Homes

While there have been stories of taxpayers using Section 1031 exchanges to swap one vacation home for another and defer recognition of gain, Congress tightened this loophole in 2004. However, taxpayers can still convert vacation homes into rental properties and conduct 1031 exchanges. For instance, if you cease using your beach house as a personal retreat, rent it out for a period, and then exchange it for another property, you can potentially qualify for a Section 1031 exchange.

According to the IRS, offering the vacation property for rent without securing tenants would disqualify it for a Section 1031 exchange.

Moving Into a 1031 Swap Residence

If you intend to use the property acquired through a Section 1031 exchange as your new second or primary home, you cannot move in immediately. In 2008, the IRS established a safe harbor rule, stating it would not dispute whether a replacement dwelling qualifies as an investment property under Section 1031. To meet this safe harbor, during each of the two 12-month periods following the exchange:

- You must rent the dwelling unit to another person for a fair rental for 14 days or more.

- Your personal use of the dwelling unit cannot exceed the greater of 14 days or 10% of the number of days during the 12-month period when the dwelling unit is rented at a fair rental.

Additionally, after successfully swapping one vacation or investment property for another, you cannot immediately convert the new property into your primary home and take advantage of the $500,000 exclusion.

Before the law changed in 2004, an investor could exchange one rental property for another through a 1031 exchange, rent out the new property for a period, move in for several years, and then sell it, benefiting from the exclusion of gain from the sale of a primary residence.

Now, if you acquire property through a 1031 exchange and later attempt to sell it as your primary residence, the exclusion will not apply during the five-year period starting from the date of acquisition through the exchange. In other words, you’ll have to wait significantly longer to use the primary residence capital gains tax break.

Section 1031s for Estate Planning

One drawback of Section 1031 exchanges is that the tax deferral will eventually end, resulting in a substantial tax bill. However, there is a workaround.

Tax liabilities cease upon death, so if you die without selling the property

obtained through a Section 1031 exchange, your heirs won’t be required to pay the deferred tax. They’ll inherit the property at its stepped-up market value. These rules make Section 1031 exchanges advantageous for estate planning.

How to Report 1031 Exchanges to the IRS

You must inform the IRS of the 1031 exchange by completing and submitting Form 8824 with your tax return for the year when the exchange occurred.

The form will necessitate providing descriptions of the properties exchanged, the dates of identification and transfer, any relationships with other parties involved in the exchange, and the value of the like-kind properties. You’re also required to disclose the adjusted basis of the property given up and any liabilities assumed or relinquished.

Accuracy is crucial when completing the form; any discrepancies may lead to a substantial tax bill and penalties.

Can You Perform a 1031 Exchange on a Primary Residence?

A primary residence typically doesn’t qualify for 1031 treatment since it’s where you reside and not held for investment purposes. However, if you rented it out for a reasonable duration and refrained from living there, it might be considered an investment property, potentially making it eligible.

Can You Perform a 1031 Exchange on a Second Home?

1031 exchanges pertain to real property held for investment purposes. Thus, a typical vacation home wouldn’t qualify for 1031 treatment unless it’s rented out and generates income.

How Do I Change Ownership of Replacement Property After a 1031 Exchange?

If your intention is to change ownership of the replacement property, it’s wise to refrain from doing so immediately. It’s generally advisable to hold onto the replacement property for several years before transferring ownership. If you dispose of it quickly, the IRS may infer that you didn’t acquire it with the intention of holding it for investment purposes—a fundamental rule for 1031 exchanges.

What Is an Example of a 1031 Exchange?

Consider Kim, who owns an apartment building currently valued at $2 million, twice what she paid for it seven years ago. She learns about a larger condominium in an area with higher rents, priced at $2.5 million. Through a 1031 exchange, Anisley could sell her apartment building and use the proceeds to help purchase the larger replacement property without immediately worrying about tax liability. This effectively leaves her with additional funds to invest in the new property by deferring capital gains and depreciation recapture taxes.

What Is 1031 Exchange Depreciation Recapture?

Depreciation allows real estate investors to reduce taxes by deducting the costs of property wear and tear over its useful life.

When the property is eventually sold, the IRS will seek to recapture some of those deductions, factoring them into the total taxable income. A 1031 exchange can delay this event by rolling over the cost basis from the old property to the new one replacing it. In essence, your depreciation calculations continue as if you still owned the old property.

The Bottom Line

A 1031 exchange can serve as a tax-deferred strategy for savvy real estate investors to build wealth. However, its many complex aspects require understanding the rules and often necessitate professional assistance, even for seasoned investors.