What is a 1031 Reverse Exchange?

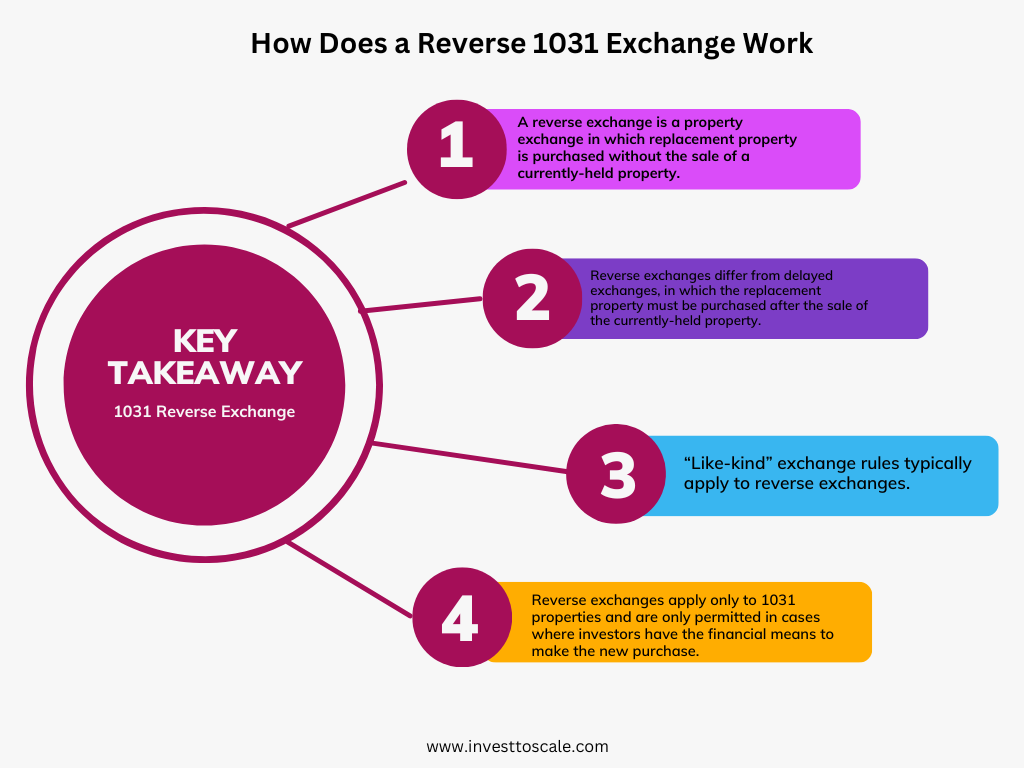

In real estate, a reverse exchange is a unique property transaction where the replacement property is acquired before the current property is sold. The concept of a reverse exchange was planned to help buyers in purchasing a new property without having to immediately part ways with their existing one. This strategy allows sellers to retain their current property until its market value appreciates, providing them with an opportunity to maximize their profits upon its eventual sale.

How does a 1031 Reverse Exchange works?

Unlike standard like-kind exchanges, reverse exchanges operate under different rules. Typically, like-kind exchange regulations enable property investors to defer capital gains taxes by reinvesting the proceeds from a property sale into a similar property.

To facilitate like-kind treatment, the IRS has established safe-harbor rules, permitting either the current or new property to be held within a qualified exchange accommodation arrangement (QEAA). Additionally, the replacement property cannot be property already owned by the investor.

Reverse exchanges are applicable solely to Section 1031 properties, often referred to as 1031 exchanges. These properties are those that businesses or investors exchange to postpone tax payments on the profits generated from their sale.

However, executing a reverse exchange is more complex than a straightforward property swap. It requires adherence to specific exchange standards and the involvement of a facilitator to oversee the process. Properties classified under Section 1245 or 1250 are ineligible for this transaction type.

Important Considerations

A critical aspect of a successful reverse exchange depends on the investor’s financial capacity to acquire the new property. Since the old property remains unsold during the exchange, the investor must have sufficient funds to finance the purchase entirely without relying on the proceeds from the sale of the old property. Financing for the new property may involve a lender, although only select lenders may be willing to engage in a reverse exchange arrangement.

Requirements for Reverse Exchanges

A reverse 1031 exchange is restricted to real property held for investment or business purposes. There’s a maximum holding period applicable to properties involved in reverse exchanges. Unlike delayed or deferred exchanges, where the exchanger must first relinquish their property before acquiring a new one, reverse exchanges are employed when an investor needs to close on the purchase of a new property before selling their current one.

The timelines for a reverse 1031 tax-deferred exchange align with those of other IRS-sanctioned 1031 exchanges. There are two crucial deadlines, and missing either one could result in tax liabilities. The IRS does not grant extensions for these deadlines.

The investor has 45 days from the property’s sale date to identify potential replacement properties and 180 days from the sale date to complete the purchase of a replacement property. It’s important to note that a 1031 exchange cannot be executed directly into a personal residence. Exchanges are limited to real property held strictly for investment or business purposes; however, an exchanger can convert an investment property into a primary residence following IRS guidelines.

45

The number of days an investor has to identify potential replacement property in a 1031 exchange.

180

The number of days an investor has to purchase replacement property in a 1031 exchange.

The IRS issued Rev. Proc. 2000-37 to provide clarity on reverse exchanges’ rules. The revenue ruling specifies that the IRS will not challenge the qualifications of properties as either replacement or relinquished, nor the exchange’s treatment for federal income tax purposes, provided the property owner adheres to the qualified exchange accommodation arrangement outlined in the ruling.

Despite the IRS ruling, some ambiguity remains regarding the structure of reverse exchanges and the responsibilities of selected third-party exchange facilitators. In a 2017 ruling (Estate of Bartell, 147 T.C. No. 5, 2016), the Tax Court rejected the IRS’s stance that exchange facilitators were required to assume the burdens and benefits of the property owners for a valid 1031 reverse exchange.

Given the evolving nature of reverse exchange regulations and their complexities, property owners should seek guidance from qualified tax attorneys or advisors before embarking on a reverse exchange.